Lingot 1 kg

Solid Gold: Sovereign Investment of 1 Kilogram.

Welcome to the world of investment excellence, where each kilogram of gold represents a fortress of value and prestige.

Why are our 1 kg gold bars the ultimate investment?

- High-end investment: A 1 kg bar is the consecration for experienced investors and wealth strategists.

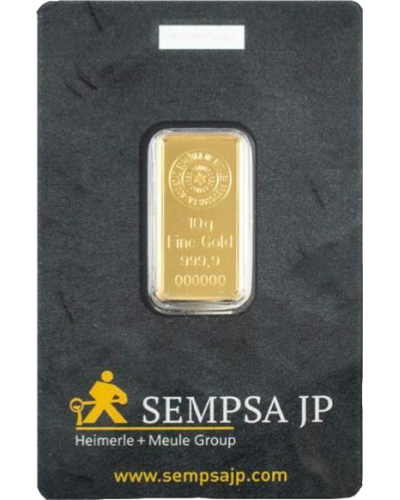

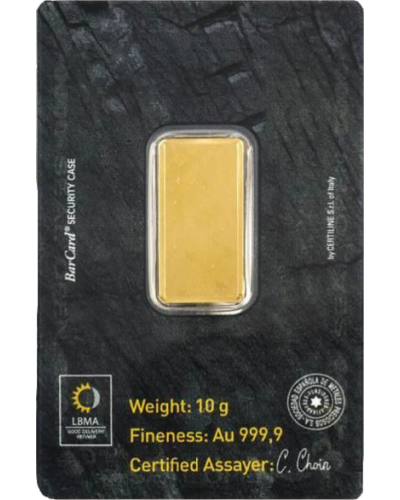

- Certified Purity: 99.99% purity, guaranteed by the strictest international standards.

- Global Value: A recognized and tradable asset on all international financial markets.

- Perfect Traceability: Each bar is accompanied by a certificate of authenticity and a unique serial number.

- Safe Haven: Optimal protection against inflation, economic crises and currency devaluation.

- Intergenerational Heritage: An investment that stands the test of time and is passed down as a precious heirloom.

- Prestige and Exclusivity: Owning a 1 kg gold bar is a way of affirming your strategic vision and financial sophistication.

An investment that combines tradition, security and exceptional performance.

Invest in solid gold - Invest in your future!

Frequently Asked Questions

Find here the main questions concerning Investment Gold.

The ounce of gold, also called “Troy Ounce” from Anglo-Saxon countries, used around the world for the quotation of precious metals such as gold or silver. One ounce is equivalent to 31.1034768 grams.

Example: In a gold bar there are 32.15 ounces

1 kg = 1,000 g or 1,000: 31.1034768= 32.15

An ounce of gold is always given in relation to 1 dollar or 1 Euro.

No, since September 1, 2010, all investment gold purchase or sale transactions must be settled by check or wire transfer.

YES, two taxation regimes are applicable.

1st regime: THE TMP (Tax on Precious Metals)

(Confers article 150 of the General Tax Code)

Individuals are subject to a flat-rate levy of 8% of the proceeds of the sale (whether there is capital gain or capital loss). This tax is made up of:

The TMP, Precious Metals Tax, the rate of which is 11.5%.

2nd regime: TPV (Taxes on Value Added Values)

(Refers to article 68 of the amending finance law for 2005)

Indeed, since January 1, 2012, sellers of so-called “investment” gold can choose to pay 36.2% on the capital gain with a discount of 5% per year from the 3rd year of holding

To do this, you must be able to prove the date and purchase value of your gold. In other words, when selling your gold, you will need to present a nominative invoice, dated, with the value of the property.

If you are purchasing investment gold, we accept certified checks as well as bank transfers, with no payment limits.

Yes, the condition of the coins is decisive. We sell on the stock exchange, on your behalf, only gold coins in good condition.

After expertise, the coins that we consider cleaned and polished or very damaged are purchased on a refusal basis, that is to say by weight.

To access French quotation prices (Fixing Paris) and place an order on the French market, you need a minimum number of coins.

All you need to do is present your gold coins in the morning before 11:30 a.m., under seal, specifying whether it is a so-called “at best” order (without a fixed price) or a “limit” order. i.e. the sale will only be made if the limit price is reached.

Yes, in this way we certify the quality and value of the coins sold in our GLOBAL CASH agencies.

In addition, we offer our seals, thus we ensure their resale by all approved organizations.

Yes, for this we must appraise them and if we consider the coins to be in “marketable” condition then we will seal them for you free of charge.