The World Standard of Investment Gold

The 1-ounce Gold Maple Leaf, minted by the Royal Canadian Mint, is one of the purest, safest, and most innovative gold coins in the world. Launched in 1979, it revolutionized the gold market by introducing:

✔ An unparalleled level of purity (99.99% pure gold, then 99.999% since 2014).

✔ Anti-counterfeiting technologies (micro-engraving, holograms, radial surface).

✔ International recognition.

Today, the Maple Leaf is the second best-selling gold coin in the world (after the Krugerrand), favored by:

• Investors for its liquidity and purity.

• Collectors appreciate its special editions and iconic design.

• Exceptional gifts (weddings, inheritances, awards).

🔍Technical Specifications

Weight: 1 troy ounce (31.1035 g)

Purity: 99.99% (24 karat) or 99.999% (5 mint) since 2014

Diameter: 30 mm

Thickness: 2.87 mm

Face Value: 50 Canadian dollars (legal tender guaranteed by the government)

Mint: Royal Canadian Mint (RCM, Ottawa)

Security: Micro-engravings (maple leaf), radial surface, hologram (special editions)

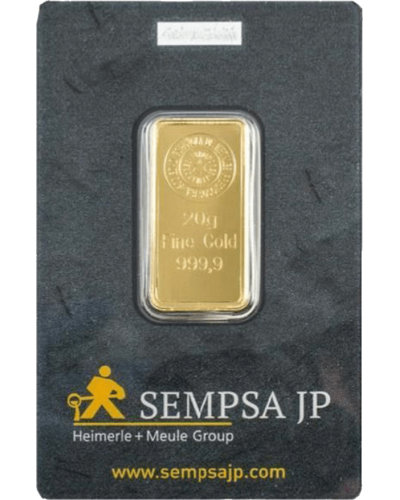

Packaging: Sealed plastic capsule or RCM blister pack (for premium editions)

Iconic Design & Unique Innovations

Obverse: Symbol of the Canadian Monarchy

Reverse: The Maple Leaf, Emblem of Canada

Why Choose the Maple Leaf?

1. Unrivaled Purity (99.999%)

2. Maximum Security

3. Global Liquidity

4. Safe Haven Asset & Capital Gain Potential

Find here the main questions concerning Investment Gold.

The ounce of gold, also called “Troy Ounce” from Anglo-Saxon countries, used around the world for the quotation of precious metals such as gold or silver. One ounce is equivalent to 31.1034768 grams.

Example: In a gold bar there are 32.15 ounces

1 kg = 1,000 g or 1,000: 31.1034768= 32.15

An ounce of gold is always given in relation to 1 dollar or 1 Euro.

No, since September 1, 2010, all investment gold purchase or sale transactions must be settled by check or wire transfer.

YES, two taxation regimes are applicable.

1st regime: THE TMP (Tax on Precious Metals)

(Confers article 150 of the General Tax Code)

Individuals are subject to a flat-rate levy of 8% of the proceeds of the sale (whether there is capital gain or capital loss). This tax is made up of:

The TMP, Precious Metals Tax, the rate of which is 11.5%.

2nd regime: TPV (Taxes on Value Added Values)

(Refers to article 68 of the amending finance law for 2005)

Indeed, since January 1, 2012, sellers of so-called “investment” gold can choose to pay 36.2% on the capital gain with a discount of 5% per year from the 3rd year of holding

To do this, you must be able to prove the date and purchase value of your gold. In other words, when selling your gold, you will need to present a nominative invoice, dated, with the value of the property.

If you are purchasing investment gold, we accept certified checks as well as bank transfers, with no payment limits.

Yes, the condition of the coins is decisive. We sell on the stock exchange, on your behalf, only gold coins in good condition.

After expertise, the coins that we consider cleaned and polished or very damaged are purchased on a refusal basis, that is to say by weight.

To access French quotation prices (Fixing Paris) and place an order on the French market, you need a minimum number of coins.

All you need to do is present your gold coins in the morning before 11:30 a.m., under seal, specifying whether it is a so-called “at best” order (without a fixed price) or a “limit” order. i.e. the sale will only be made if the limit price is reached.

Yes, in this way we certify the quality and value of the coins sold in our GLOBAL CASH agencies.

In addition, we offer our seals, thus we ensure their resale by all approved organizations.

Yes, for this we must appraise them and if we consider the coins to be in “marketable” condition then we will seal them for you free of charge.